https://noticviralweb.blogspot.com/2024/05/mejores-seguros-vehiculo.html

Ensuring the safety and protection of our vehicles is a top priority for any driver. In a world where car accidents are common and repair costs can be prohibitive, having the right vehicle insurance is essential. In this article, we will explore the best vehicle insurance options available, what to consider when choosing one, https://noticviralweb.blogspot.com/2024/05/mejores-seguros-vehiculo.html and how to find the option that best suits your needs.

1. What is Vehicle Insurance?

Vehicle insurance is a contract between a car owner and an insurance company. In exchange for regular payments known as premiums, the insurer agrees to cover costs related to damages, theft, or injuries resulting from accidents. There are different types of coverage, ranging from basic to comprehensive, which cover various risks and situations.

2. Types of Vehicle Insurance

2.1. Third-Party Insurance

This is the most basic type of insurance and generally the most affordable. It covers damages you may cause to other vehicles, properties, and injuries to other people in an accident where you are at fault. However, it does not cover damages to your own vehicle.

2.2. Comprehensive Insurance

Comprehensive insurance provides more extensive coverage. In addition to covering damages to third parties, it also protects your vehicle against damages, theft, and vandalism. This type of insurance is ideal for new or high-value vehicles.

2.3. Liability Insurance

This type of insurance is mandatory in many countries. It only covers damages you cause to other people and their properties. However, it does not cover your own damages or injuries.

2.4. Personal Accident Coverage

This coverage is useful if you want to protect the occupants of your vehicle in case of an accident. It provides compensation for injuries or death of passengers.

2.5. Theft and Vandalism Coverage

Some policies offer specific coverage for theft and vandalism. This is crucial if you live in an area with a high incidence of theft or if your vehicle is at high risk of vandalism.

3. Factors to Consider When Choosing Vehicle Insurance

Choosing the best vehicle insurance is not an easy task. There are several factors to consider to ensure you make the best decision:

3.1. Personal Needs

Evaluate your personal needs. Consider how you use the vehicle, the type of vehicle you have, and your financial situation. Comprehensive insurance may be suitable for a new car, while third-party insurance may be sufficient for an older vehicle.

3.2. Price Comparison

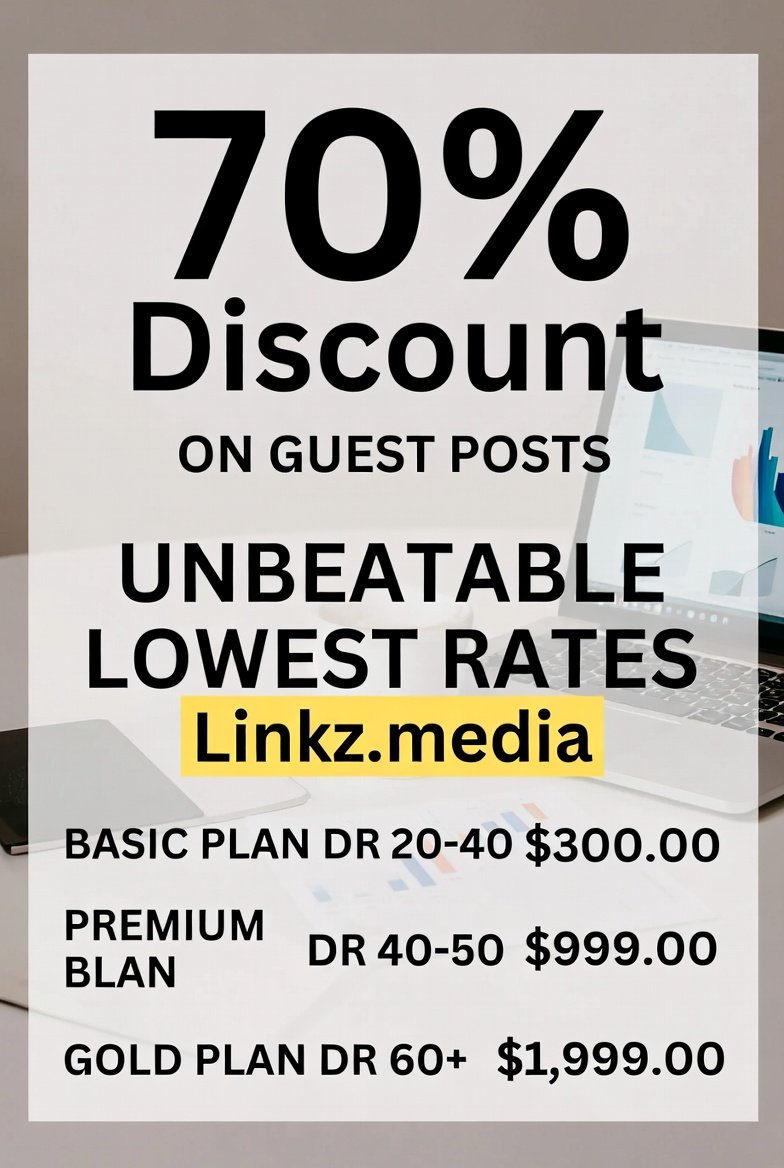

It is always advisable to compare prices from different insurers. Use online tools to obtain quotes from various companies and compare the coverages offered. The lowest price is not always the best option; ensure that the coverage is adequate.

3.3. Insurer Reputation

Research the reputation of insurance companies. Read reviews from other customers and check online ratings. A company with a good reputation is more likely to provide efficient customer service and fulfill its obligations in the event of a claim.

3.4. Discounts and Promotions

Ask about available discounts. Many insurers offer discounts based on several factors, such as being a safe driver, having a good credit history, or bundling policies (for example, auto and home insurance).

3.5. Additional Coverages

Consider if you need additional coverages that may be important for your particular situation, such as roadside assistance, rental car coverage, or personal injury protection.

4. Best Vehicle Insurance Options in the Market

4.1. XYZ Insurance

Features:

- Comprehensive coverage.

- Roadside assistance service.

- Discounts for safe drivers.

Reviews: Customers positively rate their customer service and quick claims processing.

4.2. ABC Insurance

Features:

- Third-party coverage with the option to upgrade to comprehensive.

- Discounts for multiple vehicles.

- Theft and vandalism protection.

Reviews: Known for its customer service and ease of use on the online platform.

4.3. 123 Insurance

Features:

- Customizable policies.

- Roadside assistance included.

- International coverage.

Reviews: Users appreciate the flexibility and personalization of their policies.

5. How to Save on Your Vehicle Insurance

5.1. Maintain a Good Driving Record

A good driving record can help you obtain lower premiums. Insurance companies often offer discounts to drivers with clean records.

5.2. Bundle Insurance Policies

Consider bundling your vehicle insurance with other insurance policies, such as home insurance, to receive discounts.

5.3. Choose Higher Deductibles

Opting for a higher deductible can lower your premium. However, make sure you can afford the deductible in case of a claim.

5.4. Review Your Coverage Regularly

Regularly reviewing your coverage ensures that you are not paying for unnecessary features. If your circumstances change, you might find a policy that better suits your needs.

Conclusion

Choosing the best vehicle insurance involves careful consideration of your needs, preferences, and budget. By understanding the different types of coverage available, comparing prices, and considering additional factors such as discounts and the insurer’s reputation, you can make an informed decision that provides the protection you need. Remember, the right insurance policy can offer peace of mind and financial security in case of unforeseen events.