Introduction

Australia’s business landscape in April 2024 presented a mixed picture, with varying trends in business conditions and confidence across different sectors. While some industries showed resilience, others faced challenges due to economic headwinds, interest rate pressures, and shifting consumer behavior.

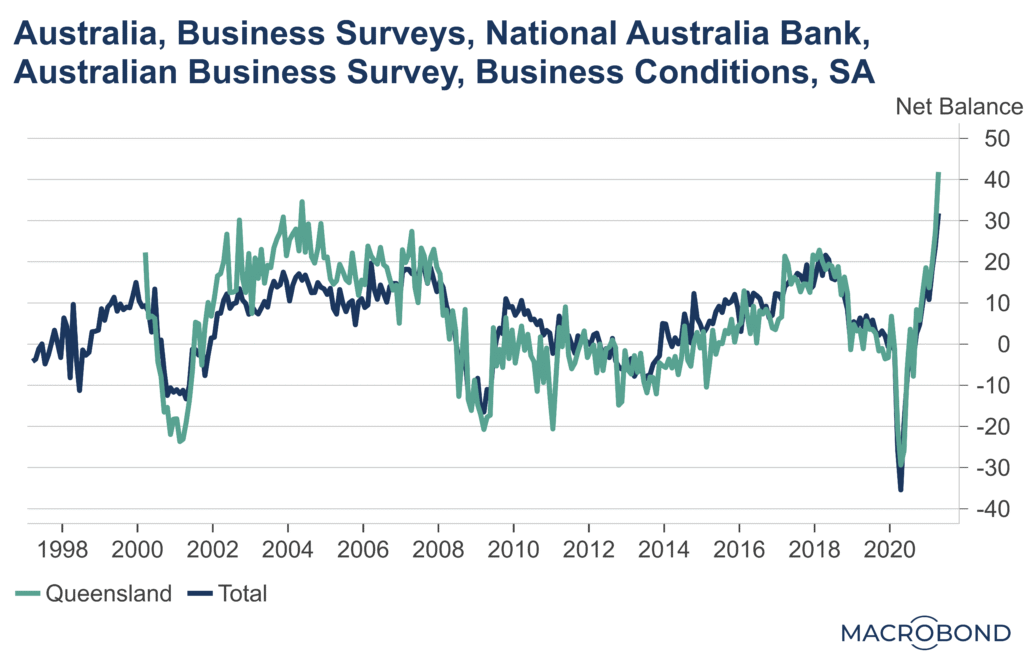

Key indicators from the National Australia Bank (NAB) Business Survey and other economic reports provide insights into how businesses are navigating the current environment. This article examines the latest trends in Australian business conditions, confidence levels, and what they mean for the broader economy.

Business Conditions Hold Steady, But Confidence Wavers

In April, Australian business conditions remained relatively stable, supported by strong employment and sales activity. According to the NAB Business Survey, the business conditions index stayed above the long-term average, reflecting ongoing resilience in the face of economic uncertainty.

Key Findings:

-

Trading Conditions: Sales and revenue held up well, particularly in consumer-facing sectors like retail and hospitality.

-

Profitability: While still positive, profit growth slowed slightly due to rising operational costs.

-

Employment: The labor market remained robust, with businesses continuing to hire at a steady pace.

However, business confidence dipped slightly, indicating that firms are becoming more cautious about future growth. The confidence index fell below the long-run average, reflecting concerns about inflation, interest rates, and weaker consumer demand.

Sector-by-Sector Breakdown

1. Retail & Hospitality – A Tale of Two Trends

The retail sector saw moderate growth in April, with consumer spending holding up better than expected. However, discretionary spending weakened as households prioritized essentials amid cost-of-living pressures.

-

Positive: Cafés, restaurants, and travel-related businesses benefited from strong domestic tourism.

-

Negative: Non-essential retail (e.g., electronics, fashion) faced softer demand.

2. Construction & Real Estate – Slowing Momentum

Higher interest rates continued to weigh on the construction sector, with new home building approvals declining.

-

Residential Construction: Demand softened as mortgage costs remained elevated.

-

Commercial Construction: Infrastructure projects provided some support, but overall activity slowed.

3. Manufacturing – Stabilizing After a Tough Period

Manufacturing conditions improved slightly, supported by domestic demand and easing supply chain disruptions. However, global economic uncertainty kept export orders subdued.

4. Mining & Resources – Steady but Cautious

Commodity prices remained favorable, supporting mining sector profits. However, confidence was tempered by weaker global demand, particularly from China.

Factors Influencing Business Sentiment

1. Interest Rates & Inflation

The Reserve Bank of Australia (RBA) kept interest rates on hold in April, but businesses remain wary of potential future hikes. Inflation, though moderating, is still above the RBA’s target range, squeezing margins for many firms.

2. Consumer Spending Slowdown

Household budgets are under pressure, leading to more cautious spending behavior. Businesses reliant on discretionary income are feeling the pinch.

3. Labor Market Tightness

While employment remains strong, skill shortages persist in key industries, driving up wage costs and operational challenges.

4. Global Economic Uncertainty

Ongoing geopolitical tensions and slower growth in major economies (China, Europe) are affecting export-oriented businesses.

Regional Variations

-

New South Wales & Victoria: Business conditions were strongest in these states, supported by robust services sectors.

-

Queensland & Western Australia: Mining and tourism helped maintain steady performance.

-

Tasmania & South Australia: Smaller economies faced more pronounced slowdowns in confidence.

What’s Next for Australian Businesses?

Looking ahead, businesses will need to navigate several key challenges:

-

Cost Management: With inflation still a concern, firms must optimize operations to protect margins.

-

Consumer Demand: Companies should focus on value-driven offerings to attract cost-conscious shoppers.

-

Policy Uncertainty: The RBA’s next moves on interest rates will be critical for borrowing costs and investment decisions.

-

Digital Transformation: Businesses investing in automation and AI may gain a competitive edge.

Conclusion

Australian business conditions in April 2024 demonstrated resilience, but confidence levels reflected growing caution. While some sectors, like retail and hospitality, showed pockets of strength, others, such as construction and manufacturing, faced headwinds.

The path forward will depend on how well businesses adapt to economic pressures, consumer behavior shifts, and policy changes. For now, the Australian economy remains in a holding pattern—stable but not without risks.

Key Takeaways:

-

Business conditions remain steady, but confidence is softening.

-

Retail and hospitality are mixed, with discretionary spending under pressure.

-

Interest rates and inflation continue to influence business decisions.

-

Adaptability will be crucial for sustained growth in 2024.

As we move deeper into the year, monitoring these trends will be essential for policymakers, investors, and business leaders alike.